While Malaysia’s government has utilized smart policies to counter falling oil prices and diversification challenges, political conflict within the ruling party is harming the business environment and is causing economic instability.

Malaysia scores high in political risk. Since April, its Prime Minister has faced increasing pressure to step down. Clampdowns on civil society are increasingly frequent. Finally, the price of one of its largest exports, oil, has slumped.

Consequently, the Asian Development Bank predicted Malaysia would grow 4.7% in 2015. While this is still economically healthy, it is much lower than the 6% levels it achieved in 2014.

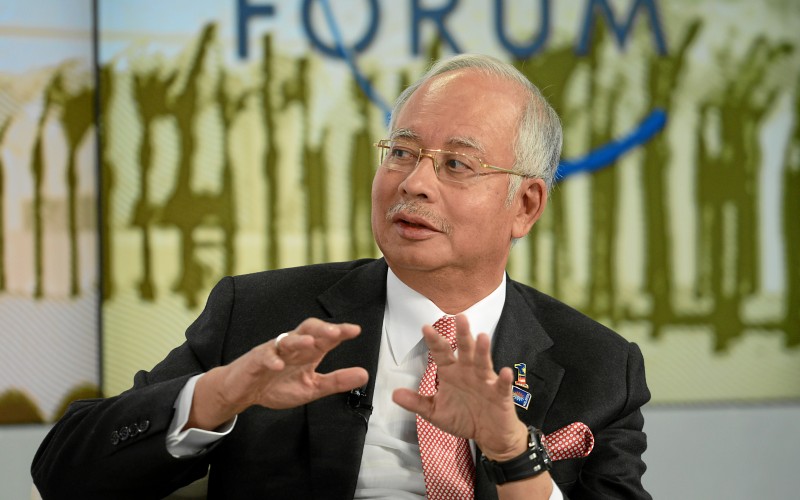

Since April of this year, there have been multiple calls for Malaysian Prime Minister Najib to resign. This mostly stems from his alleged mismanagement of state fund 1Malaysia Development BHD (1MDB). 1MDB is reportedly over $11 billion in debt and several have accused the PM and his family of siphoning off funds.

Despite PM Najib’s insistence that he will not step down, pressure is growing from Mahatir Mohamed, Malaysia’s former leader who ruled for 22 years. Mahatir still holds a strong following amongst Najib’s party, the United Malays National Organisation (UMNO). Consequently, the calls for the PM to step down have not only appeared in the opposition, but also from within his party.

This has created a situation in which businesses seeking opportunities requiring the go-ahead from the PM’s office, such as large scale investment projects, have adopted a ‘wait and see’ approach.

As a result, huge investment opportunities, such as a proposal for a cold LPG storage facility, which has the potential to save the country billions of dollars over the long term and secure part of Malaysia’s energy supply, have been forcibly delayed – evidently affecting the economy and, in this case, national security.

The problem is not that PM Najib is still in power, but rather that businesses need stability to move forward. It would be too costly for a business to gain the PM’s approval and begin investing, only for him to step down and his successor to cancel the project.

Clear signs are needed from both sides of the political spectrum for the economy to progress. Therefore, once stability can be guaranteed, the brakes on private investment will come off with the potential to greatly increase the slagging growth rate.

Malaysia has also increasingly used its laws to limit freedom of speech and information. Laws such as the recently passed Anti-Terrorism Law and Strengthened Sedition Act have been implemented in the interest of national security. However, human rights groups have documented scores of arrests of people simply exercising their freedom of expression while recording increasing curbs on the media.

The problem is that the use of these laws pulls at the delicate social fabric of Malaysia and generates socioeconomic instability, ultimately harming the business environment of the country. Other countries with similar clampdowns have faced staggering economic losses. A quick glance across the border to Thailand shows the potential depression Malaysia could face if it continues down this road.

Lastly, the fall of global oil prices has contributed to Malaysia’s passive growth. Malaysia is one of the largest oil exporters in the Asia Pacific region, and the decline of prices has been felt hard within the government. However, this is a global phenomenon, and through smart policymaking, Malaysia has managed to considerably soften the blow.

While the government has sought to diversify its exports, it also reduced its fuel subsidy program and implemented a 6% Goods and Services Tax (GST) which came into effect on the 1st of April. These policies will help alleviate the deficit, although it is too early to tell by how much.

Furthermore, the weaker Malaysian Ringgit has made it easier for other manufacturers to export their products. These circumstances have allowed Malaysia to beat economic forecasts for the first quarter of 2015.

While Malaysia’s economy is highly developed, it would be unwise to believe its performance will be unaffected by the political risks it faces. The government has shown it is capable of producing smart economic policies. It should now start making smart political decisions, too.

sourche: http://globalriskinsights.com/2015/06/malaysias-political-risk-produces-mixed-performance/

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου