With a political deadlock causing a 16-month vacancy of the presidential seat, a garbage crisis that has triggered an anti-government movement, and an unprecedented flow of Syrian refugees making up 25% of the country’s population, Lebanon does not look very attractive to investors.

Lebanon’s electoral system was designed to reflect the country’s multi-confessional character.

The political system put in place in Lebanon is based on power sharing between a Maronite Christian president, a Sunni Prime Minister, and a Shiite Parliament Speaker. Therefore, consensus is key at all levels in order to ensure the proper functioning of Lebanon’s political system.

The fact that Lebanon has been without a president since President Suleiman’s term expired in May 2014 means that political actors have failed to see eye-to-eye. Indeed, Lebanon’s chronic power shortage is partially caused by the political class’s inability to reach a consensus and adopt a policy for oil and gas exploitation, or any other legislative decision, for that matter.

While Lebanon’s power sharing system contributes to the country’s political paralysis, another key reason behind the country’s deadlock is Lebanon’s position as a proxy for regional conflicts.

Lebanon’s two major political groups — The March 8 Alliance, backed by Shiite Hezbollah, and the March 14 Alliance, with Hariri’s Sunni Future Movement as its main player — reflect the regional rivalry between Iran and Saudi Arabia, respectively.

In fact, in a recent interview, Prime Minister Salam stated that 11 of Lebanon’s 12 presidents since its independence have “either been suggested or produced by external powers,” and later warned regional powers of the danger of using Lebanon as a proxy to settle regional conflicts.1

However, as long as the Syrian civil war drags on, any common ground between Saudi Arabia and Iran will be difficult to establish, leaving any political consensus in Lebanon very difficult to reach.

In last month’s presidential election session, the parliament failed once again to reach quorum and elect a new president—the 29th time in a row.

Refugee crisis

Lebanon’s second challenge, also caused by regional instability, is the refugee crisis.

Since the war in Syria erupted, Lebanon has seen a major flow of refugees crossing its borders. Today, Lebanon is home to approximately 1.6 million Syrian refugees, in addition to roughly 500,000 Palestinian refugees.

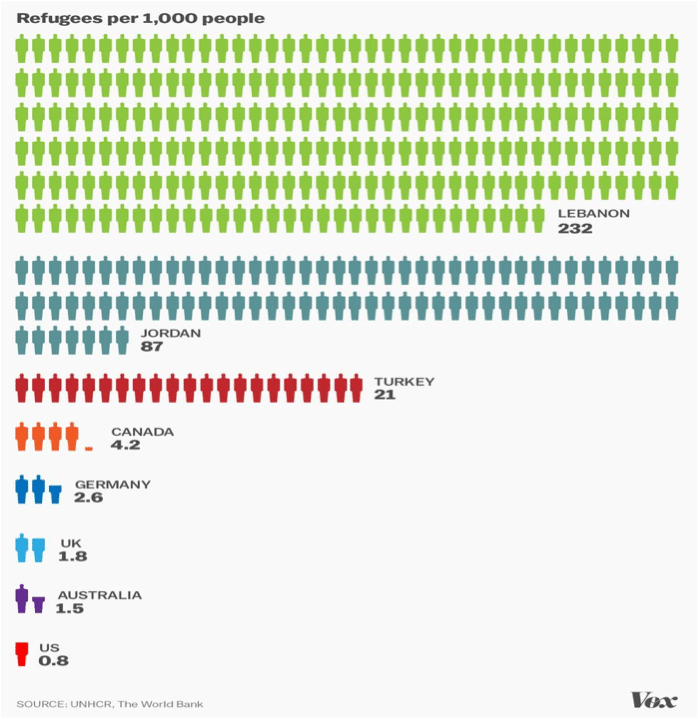

With a population of less than 5 million people, this represents almost 50% of Lebanon’s population, making it the highest per-capita concentration of refugees in the world.

Source: UNHCR, The World Bank, Vox

An economic slowdown

The overwhelming flow of Syrian refugees, along with Lebanon’s poor infrastructure, have aggravated already-existing problems of high unemployment, poverty, and lack of public services.

In addition, the Syrian civil war has also affected Lebanon’s ability to export goods on the international market. In April, Lebanon’s main land route used for exports to Jordan and the Gulf countries, the Nassibborder crossing, was shut down as Syrian rebels took control, causing a brutal drop in exports. This has contributed to the nearly $1.5 billion deficit in the country’s balance of payment and subsequent economic slowdown.

Due to Lebanon’s disrupted economic and commercial activities, the Institute of International Finance (IIF)now predicts real GDP growth rate of 1.1%, compared to its initial prediction of 2.2% earlier this year.

Furthermore, a recent report by the World Economic Forum (WEF) revealed that Lebanon was among the worst ranking countries in the Global Competitiveness Index, ranked 101 out of 140 countries. Poor performance was based on weak rankings in other areas, such as government instability, poor infrastructure, corruption, wastefulness of government spending, and lack of public services.

Faced with chronic corruption and political instability, foreign investors will continue to be deterred, leaving the economy to remain among the least competitive in the world.

The Central Bank: Lebanon’s guardian

However, Lebanon’s robust and reputable banking sector remains relatively reassuring for investors. In the midst of the country’s political squabbles, the Central Bank has stood as a bastion of stability.

The Lebanese government has relied on the Central Bank, one of the country’s most reliable institutions, to fund public and private sector needs, and to put in place stimulus packages aimed at boosting local demand, incentivizing the private sector, and supporting small-and-medium enterprises.

Moreover, the Central Bank has been able to safeguard investors’ confidence in Lebanon’s financial markets by stabilizing the exchange rate and boosting the country’s foreign currency reserves from $39.5 billion to a record high of $40.2 billion.

Confidence in the Lebanese banking sector is not only reassuring for investors, but for the Lebanese diaspora, as well. This is crucial for the remittance-based economy, with approximately 20% of GDP dependent on the 14 million expatriates regularly depositing money in Lebanese banks. Despite the country’s turmoil, deposits have remained steady.

What next for Lebanon?

During the course of the summer, many argued that the “You Stink” movement, triggered by the garbage collection crisis following the closing of the country’s main landfill, could have been a defining moment in Lebanon’s political trajectory. Indeed, the garbage crisis was the catalyst for an anti-government movement criticizing the corruption and patronage embedded in the country’s political class.

However, with the country’s politics driven by sectarian divisions and regional conflicts, Lebanon’s fate is closely linked to the developments in Syria.

Russia’s recent intervention in Syria is changing the dynamics of the Syrian civil war, which could present Lebanon with further complications.

In the best case scenario, Russian intervention in Syria could halt ISIS’s progress into Syrian bordering towns with Lebanon and consequently reduce the latter’s security threats while setting the stage for realistic talks between regional powers, ultimately easing Lebanon’s deadlock.

On the other hand, as long as the crisis in Syria worsens and the heightened rivalry between Iran and Saudi Arabia continues, Lebanon will likely remain politically paralyzed.

In the meantime, Lebanese policy-makers will likely seek to maintain this unsustainable status quo by coming up with short-term, stop-gap solutions to the country’s challenges, such as the garbage emergency plan, and continuing to rely on the Central Bank to prop up the ailing economy.

sourche: http://globalriskinsights.com/2015/10/political-stalemate-in-lebanon/

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου