The depletion of most of the world’s most pivotal natural resources looms on the horizon, but state and private companies engaged in extracting, cultivating, and trading raw materials have proven reluctant to sufficiently factor in the risk of finite resources in their business models.

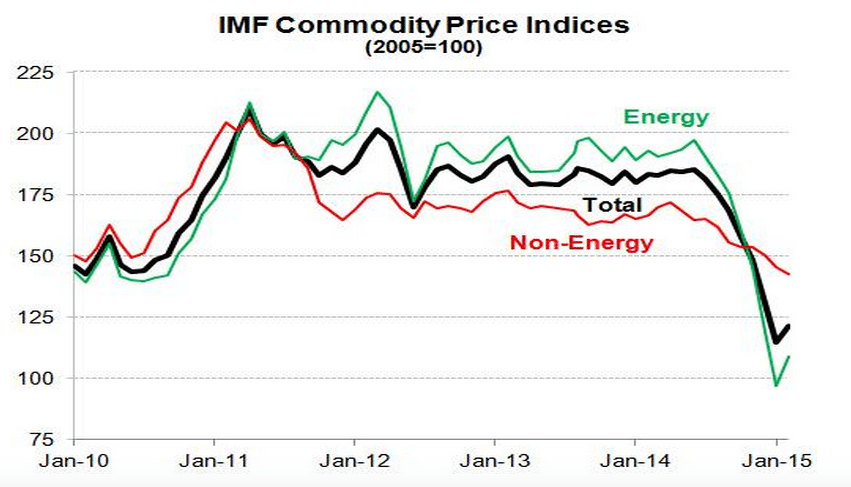

The years 2013-14 largely recorded a dramatic drop in commodity prices. For 2015, projections remain negative. Even for the next years to come, the pace of recovery will be moderate.

Multiple reasons account for this, but with certainty, China’s stalled economic engine lies at the very heart of this development, since China has become the world’s largest importer of basically any hard and most of the soft commodities. And therefore, any sluggish Chinese economy directly affects global demand. Projected Chinese economic growth rates for 2016 and 2017 will also continue to fall below an estimated 7%.

Another factor is the correlation between currency fluctuations and commodity prices. A strong US-dollar has certainly aggravated the crash of prices across various commodity sectors.

Plummeting prices for a wide range of raw materials have caused severe revenue losses for plenty of private and state-owned commodity trading companies including (covering the timeframe 2014 – Q1, 2015): Chevron(oil), BP (oil), Exxon Mobile (oil), Glencore-Xstrata (oil, metals & minerals), BHP Biliton (metals & minerals), Rio Tinto (metals & minerals), Dangote Group (soft & hard commodities), Cargill (soft commodities) or Vale (metals & minerals).

Some firms are slowly recovering after partially posting the lowest corporate profits in a decade in 2013/14 such as Alcoa (diverse), Vitol Group (oil, metals & minerals), Mercuria (soft & hard commodities), Trafigura(metals & oil), Louis Dreyfus (diverse), Bunge (diverse), Archer Midland Daniels (soft commodities) or Gunvor Group (diverse).

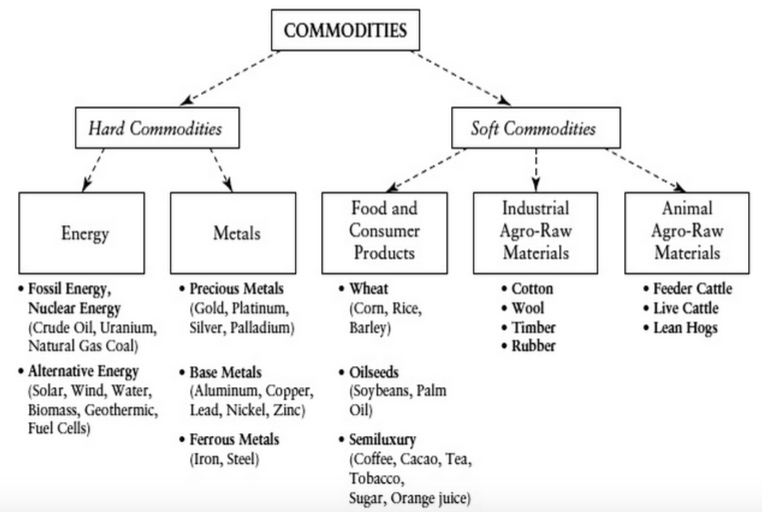

Soft and agricultural commodities versus hard commodities

Prices can and will recover, but against this backdrop, it is imperative to see the bigger picture and to take a more long-term vantage point on strategic challenges the industry will face within the next 10 to 40 years from now.

Current restructuring processes within the industry, primarily based upon mergers, the sell-off of commodity units, company takeovers or even bankruptcies scratch the surface of an underlying, more profound issue only, namely the fallacy of infinite natural resources and the inefficient use of those.

Without going into detail, the majority of hard commodity assets such as oil, gold, iron and copper got crushed in 2014 and are only slowly recovering in early 2015.

With regards to soft commodities such as live cattle, wheat, cotton or sugar prices are expected to increase this year. Other assets including soy oil, palm oil, coffee or corn will stagnate or perform worse. Generally speaking, over the course of the last five years, soft commodities have less fluctuated in prices than hard ones, though (see chart below).

Will the planet’s natural resources really deplete?

As their business solely depends on a limited number of specific raw materials, commodity trading firms are highly vulnerable to volatile market price fluctuations and the still-available reservoirs. However, by the middle of the 21st century, many crucial resources to industrial production and global supply chains will face a near-depletion or extreme scarcity level.

For instance, sand which is extracted from the bottom of the ocean, beach lines, river and gravel beds and irreplaceable to the global construction industry, will have vanished by up to an estimated 90% within the next20 to 40 years. Fossil fuels including crude oil, natural gas, coal and uranium are expected to face severe production shortages within the next 10 to 50 years.

Additionally, the EU has identified 20 highly critical non-fossil materials. Moreover, the world’s copper reserves will be exhausted by around the 2030s, nickel and aluminium by the 2050s and iron by the 2060s. Others such as germanium (by 2017) or indium (2018) are expected to deplete already way earlier.

Against this backdrop, it is worthwhile mentioning that in the advent of new extraction technologies (such as fracking) peak projections of most of the planet’s natural resources have been highly flawed in the past, particularly concerning the global reserves in conventional oil.

Also given that only a few percent of the planet’s (sub)surface have been explored in detail, it is argued that the potential for discovering new natural resource deposits is vast. Because of this, the main concerns must be associated with sustainable exploitation of resources, rather than geological scarcity as materials have more perpetual resources due to higher efficiency rates generated from new technologies.

However, the general public is widely unaware of the grave scarcity of multiple renewable resources that are most vital to mankind’s survival. Consequently, they will deplete sooner than fossil fuels.

The massive decline in fresh water, groundwater, arable land & soil for agriculture and livestock farming, grain yields, fishing, phosphorus or rainforests is already taking its toll on millions of people around the globe and driving surging numbers of violent conflicts between states as those renewable resources have passed their peaks, many already 10 years ago.

The last frontiers are under siege

It is widely considered that the world community is already engaging itself in the final global scramble for what is left in natural resources.

Be it the territorial disputes in Southeast Asia, the tapping of Greenland’s energy deposits, the aggravatingmilitarization of the Arctic, the race for Antarctica, the deforestation of the global rainforests or the struggle for Africa’s resources since the 2000s: Russia, USA, the EU, Japan, India, China amongst others have consistently stepped up their influence in the last untouched areas of the blue planet with China being at the forefront, however.

Furthermore, in order to counteract the degradation and loss of arable land multinational companies have shifted their activities to the global rainforests in Latin America, Africa and Southeast Asia leading to a new form of colonisation and an even higher pace of deforestation.

What needs to be done

Private and state-owned commodity trading companies themselves as much as governments can massively impact on how long the world’s natural resources can and will last:

- By ramping up corporate investment into research & development (R&D), recycling and resource substitution

- By re-channelling governmental subsidies and re-allocating private FDI into alterna-tive investment portfolios

- By scaling up sustainable resource management (starting already at the extraction level) and recognising sustainability as an equitable business branch vis-a-vis other corporate practices

- By increasing the life span of electronic devices and manufactured goods

- By supporting the creation and re-adjustment of protected biodiversity and natural zones in cooperation with local authorities and NGOs

- By ostracizing greenwashing efforts

- By ensuring and setting new social and environmental standards in global supply chains and adhering to international trade laws and WTO standards

- By contributing to fight commodity speculation on financial markets, resource supply disruption (i.e. export limitations) and monopoly & oligopoly market structures

- By aiding to alter consumption patterns

What does the future have in store?

The global construction boom will persist since infrastructure projects reach even larger dimensions. Some of the biggest ventures comprise the Chinese effort to create five clusters of megacities; the construction of theworld’s largest airports; the railway through South America or the Nicaraguan Canal.

So will global FDI in mining, oil and gas drilling. More importantly, fossil fuels are still subsidised by $5.4 trilliona year which surpasses the world’s entire governmental spending on health.

In this respect, The Earth Overshoot Day serves as a key indicator for how fast mankind is consuming its annually available resources. Year by year this day falls on an earlier date. In 2014, mankind had already consumed all of its annual resources by 19th August meaning that until the end of the year it lived on credit.

This development leads to the fact that the planetary boundaries are pushed to existential danger zones and beyond a point of no return. Four out of nine of these boundaries (including arable land use and phosphorus cycles) have passed critical stages.

Accordingly, the overall resource consumption is expected to increase from 60 billion tons a year to 100 billion by 2030. If the trend continues, humanity will require two Earths by 2050 to satisfy its insatiable demand for raw materials.

This will particularly be the case when the world community fails to finally disconnect its population growth from the parallel demand increase in natural resources and when the global megatrends such as middle class growth, skyrocketing demographics (10 billion by 2100), individual empowerment and urbanization will prove true.

However, only time will tell how long the planetary natural resources will ultimately last.

sourche: http://globalriskinsights.com/2015/05/what-can-be-done-to-stop-the-depletion-of-the-worlds-natural-resources/

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου